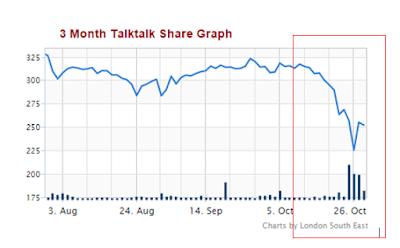

This is the message that you are greeted with on the website for one of the world’s biggest telecoms group, TalkTalk PLC. On Thursday 21 October the news broke that police had commenced a criminal investigation into the cyber-attack on TalkTalk, leaving 4.2million customers’ details including contact numbers and payment information exposed. However, the Company managed to disclose the news 24 hours after they had been made aware. The share price subsequently nosedived 10 per cent as further revelations were disclosed with regards to exactly what and who had been effected and statements from CEO Dido Harding claiming ”stolen customer data may not have been securely encrypted” did little to keep their head above water.

Would the graph look so similar if the company had developed a better, more stringent crisis communications strategy? Looking at Fig.1 the share price dipped during August. This depicts one of the two previous data breaches that the Company suffered and had this not been dismissed as a ‘blip’ then potentially the topography of this share graph would tell a different story.

Crisis communications, if not a desired consideration, should be ready and waiting in reserve to protect your company from any future bad news or operating faults, that you can respond in the most efficient, transparent and effective way to uphold your reputation as well as the safety of your customers and shareholders. Information security consultant Paul Moore rightly so states that ‘more worrying than the breach itself, had been TalkTalk's response to it’. There is a key to addressing the many communications issues related to crisis and disaster, of which TalkTalk have not handled correctly:

1. Anticipation of crisis:

Problem: TalkTalk had previously become exposed to data hacking and therefore should have placed measures to not only protect networks but individual data

It is not a matter of if it is a matter of when, cyber security especially is a must for companies storing the details of consumers, preparation is key.

2. Assessing the risks:

Problem: TalkTalk claim that they are unsure as to whether the data of customers bank details were encrypted, as confirmed by the broadband provider

With the level of technology available a company must have access to analogous detail, this is a good message to send to your shareholders if not your customers.

3. Communication and notification:

Problem: The lag time in notification from security breach to announcing this to their customers. People were left puzzled as to why the website was ‘closed for maintenance’ on Wednesday morning.

How will your news be shared with investors and/or the public, the quicker and more direct the better. Trust is based on communication and evidently leaving your investors and customers in the dark can break that trust.

4. Evaluation and analysis:

Problem: TalkTalk failed to learn from previous crisis: fail to plan - plan to fail

After the smoke clears revise the reaction and handling to secure your anticipation methods, think of the crisis as a vaccination, you come out stronger.

Hindsight is a beautiful thing however in the business world companies like TalkTalk cannot afford to simply tape up holes in the structure of their strategy of crises management.

Specifically cyber intelligence is advancing faster than some companies can develop their defenses, both systematically and managerially there is a drive to evolve rapidly to build resistance for the future and crisis. If a company can develop and format a clear and concise crisis management scheme then it should in theory be ahead of the game and ‘hacking’ can return to Horse and Hound.

This week, Abchaps hosted a market lunch, where respective opportunities in the M&A and IPO markets, as well as issues surrounding diversity in the City, were discussed. Our CEO Julian Bosdet also attended a dinner hosted by Nabarro to discuss the development of AIM.

KPMG has appointed Catherine Grum as its Head of Family Office. She joins from Salamanca Group where she was Managing Director and Head of the Private Office. Daniel Williams has been appointed global head of internal audit at the IG Group, having previously been head of internal audit for Europe, the Middle East and Africa at BGC Partners. Finally, Macquarie Investment Management appointed Gillian Evans as head of UK institutional distribution. She joins after 10 years at Goldman Sachs.

“Blip” - an unexpected, minor, and typically temporary deviation from a general trend.

Fed up with Halloween already? On Saturday, Regent Street’s sweep from Piccadilly Circus to Oxford will be filled with bumper to bumper cars as the UK’s largest free-entry motoring show rolls into town. Containing vehicles of all ages and abilities, from veteran cars straight out of period dramas to racing and eco automobiles, this year’s showstopper will include Aston Martin’s bespoke DB10, created especially for the new Bond film ‘Spectre’, of which only 10 were made for filming, out of which only 3 survived.

If you happen to be a car fanatic, the following day (Sunday 1 November).some of the classic cars involved will assemble again, early in the morning in Hyde Park, before setting off to Brighton for the London to Brighton Veteran Car Run. This annual event began in 1896 when the law requiring motorists to have a man bearing a red flag preceding their cars was abolished. Car owners celebrated by destroying their flags and setting off for Brighton in the 'Emancipation Run'. The first organised run took place in 1993 and today the event attracts owners of veteran cars built pre-1905 from all over the world.

Christmas really is approaching as the Oxford Street Christmas lights are switched on this Sunday. The Oxford Street Christmas lights will see 1778 snowball-like decorations (and their 750,000 LED lightbulbs) lit up once again for what is the fifty-sixth year the road has been decorated for the festive period. In a subtle upgrade from last year's display, 445 new golden baubles will twinkle among the existing silver lights. Kylie Minogue will do the honours, and a stage outside the Pandora Marble Arch store will host live musical performances and celebrity presenters from 5.30pm including Foxes, Fleur East, Gabrielle Alipin, ‘X-Factor’ winner Ben Haenow and performers from ‘Matilda the Musical’.

Follow us on Twitter @AbchurchComms